An AI agent for trading is quickly becoming an indispensable tool for modern investors, ushering in a new era in the financial sector. More than just automated software, it is an intelligent virtual assistant capable of analyzing complex data, predicting market trends, and executing trades with high precision to optimize profits and mitigate risks.

Contents

What is an AI agent for trading?

In the context of industry 4.0, the concept of an AI agent for trading is no longer foreign to the investment community. Simply put, it is a computer program or an autonomous system integrated with artificial intelligence (AI), particularly machine learning and deep learning algorithms. Its primary goal is to perform trading activities on behalf of investors in financial markets such as stocks, forex, or cryptocurrencies.

Unlike traditional trading bots that operate on pre-programmed rules (if-then), a sophisticated AI agent for trading possesses the ability to learn and adapt. It continuously analyzes new data, adjusting its strategies to align with the ever-changing market dynamics. This creates a superior advantage, enabling it to make smarter and more flexible decisions compared to older automated methods.

Core operating principles

To fully grasp the power of an AI agent for trading, we need to understand its operational process, which typically involves four key stages:

- Data collection: The system gathers a vast amount of data from multiple sources in real-time. This data includes historical prices, trading volumes, economic indicators, global financial news, and even sentiment analysis from social media.

- Analysis and pattern recognition: Using complex AI algorithms, the agent processes the collected data. It searches for patterns, correlations, and hidden signals that are difficult for humans to detect. This stage is the heart of the system, where the intelligence of the AI is most evident.

- Prediction and decision-making: Based on the analysis, the agent makes forecasts about future price trends. It then decides on the optimal action (buy, sell, or hold) based on the profit targets and risk tolerance levels previously set by the investor.

- Trade execution: Once a decision is made, the agent automatically sends the order to the exchange for immediate execution. The execution speed, measured in milliseconds, helps capture the smallest opportunities and minimizes market slippage.

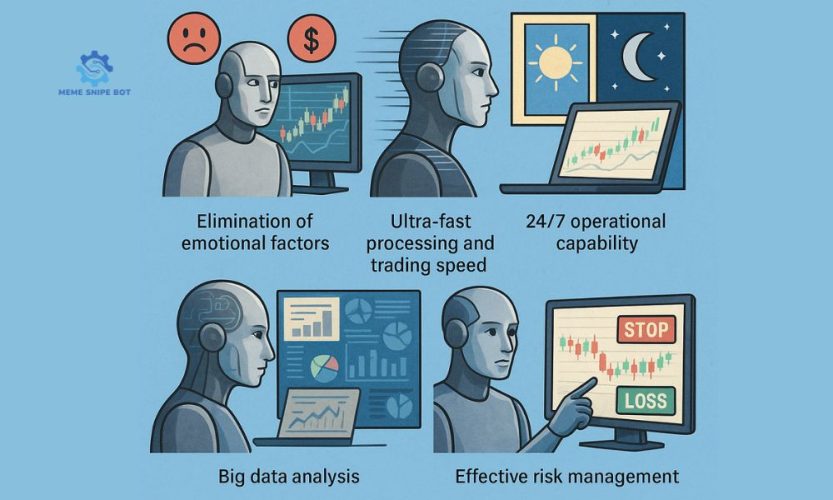

The outstanding benefits of an AI agent for trading

The application of this technology brings numerous breakthrough benefits for investors, from individuals to large institutions. An AI agent for trading can fundamentally change how we approach the markets.

Elimination of emotional factors: Fear and greed are the two biggest enemies of an investor. An AI agent for trading operates purely on logic and data, completely removing impulsive decisions driven by emotions and ensuring strict adherence to trading discipline.

Ultra-fast processing and trading speed: Financial markets fluctuate every second. AI can analyze and execute thousands of trades in the time it takes a human to read a single news report, providing a significant competitive edge.

24/7 operational capability: The forex or crypto markets never sleep. An AI agent can monitor and trade continuously 24/7 without rest, ensuring no potential opportunities are missed.

Big data analysis: No single expert can read and process all the news, financial reports, and market data generated daily. AI accomplishes this with ease, enabling decisions based on a more comprehensive and complete picture.

Effective risk management: Investors can set strict risk management rules such as stop-loss and take-profit orders. The AI agent will rigorously adhere to these rules, helping to protect the account from adverse market movements.

Challenges and considerations

Despite its many advantages, deploying an AI agent for trading also comes with certain challenges. The cost of developing or subscribing to an effective AI system can be quite high. Furthermore, it requires users to have a certain level of technological and market knowledge to properly configure and monitor its operations.

Another risk is the “black box” phenomenon, where the AI’s decisions are sometimes too complex for humans to fully understand the reasoning behind them. Therefore, continuous monitoring and the ability to intervene when necessary remain crucial. Investors should not become entirely dependent but should view the AI agent as a powerful assistant, a tool that supports their overall strategy.

In summary, the AI agent for trading is no longer a science fiction concept but a powerful tool helping investors enhance efficiency and manage risk better. To stay updated on the latest financial technology trends, make sure to follow the articles on Blogmeme.